Be Your Own Activist

Gregory V Milano | November 30, 2009

“Long Term Liabilities” was the title above pictures of a CEO and his board in a November 2005 Wall Street Journal ad that claimed these directors were creating more value for themselves than shareholders. Directors, executives and rank and file employees were horrified.

The ad was the work of Relational Investors, one of a growing number of well funded activist investment funds seeking to generate returns via active engagement of management to change course on operating and financial strategies. They often start out cooperative with management but, if rebuffed, they sometimes turn to such daunting tactics.

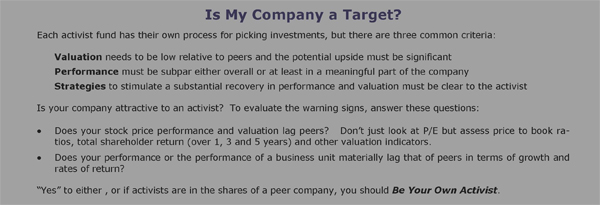

Be aware that activists have evaluated your company using in-depth valuation analyses and performance benchmarking to decide if you are a high priority target, a situation worth monitoring or a company to avoid. They reevaluate your company regularly using valuation and performance screens.

To keep activists looking elsewhere, businesses must deliver superior operating performance and share price returns. It is imperative to know how activists select targets by evaluating performance, valuation and strategies. Companies that lag in valuation or performance relative to expectations must change the game by taking sensible actions to close value gaps, even if uncomfortable, before an activist appears.

As in sports, when dealing with activists, the best defense is a good offense. To keep activists away, you must Be Your Own Activist!

Activist Investors are Proliferating

The prevalence and funding of activists has been on the rise for two decades. In a 2005 Boston University paper, Jacob Oded and Yu Wang claim the activists monitor managements by filling a void left by the decline in securities analysts. While this “monitoring” explanation is plausible, activists are able to attract money to their investment funds because they deliver superior returns.

This monitoring and oversight theme was picked up by Mary Schapiro, chairman of the SEC, who seeks to give shareholders… “a greater say on who serves on corporate boards and how company executives are paid…”. She claims investors are looking to the SEC to protect them. This rings loudly in an era where Enron, WorldCom, General Motors, AIG and Madoff have crippled the confidence of the public and the media.

To add to the regulatory pressure and public skepticism, the current recession and recent stock market trough have penalized company valuations and exposed weak strategies. Even passive investors have become receptive to outside ideas on how to improve performance and valuation, and are more likely to back transformational proposals.

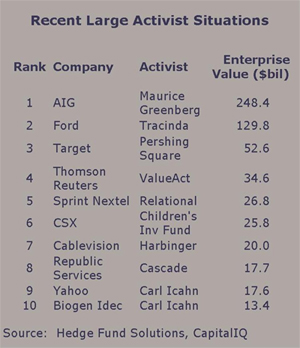

Despite the market rebound, there are nearly 500 US companies with enterprise values above $100 million trading at forward PE ratios of 12x or below. And many companies with higher PE ratios are still trading lower than many experts think they should be. Such low stock prices spawn activist opportunities and, per Hedge Fund Solutions, there were 360 activist situations in the U.S. this year, up 11%. Large well known companies are not impervious to these confrontations.

The Changing Focus of Activists

Historically, activists targeted companies they accused of financial mismanagement and demanded financial engineering solutions. They sought companies holding cash with low debt leverage, and often recommended large share repurchases.

In 2006 Carl Icahn announced a position in Macy’s and by mid 2007 Macy’s bought back $4.3 billion of its shares financed partially with debt. By May 2008, Icahn sold his shares while management and the remaining shareholders were left carrying nearly $2 billion of extra debt during a credit crisis.

While activists still dislike cash accumulation and unlevered balance sheets, the credit crisis has reduced the ability to borrow and the propensity for a jump in the stock price on the news of financial engineering.

Hardly deterred, the activists broadened their search for investment ideas by paying more attention to low valuations they attribute to poor strategy, poor execution, mismanagement of the company’s assets or investments, or management incentives that don’t encourage value creating behavior. Activists encourage cost containment to boost returns, selling underperforming businesses, abandoning announced acquisitions and exploring the sale of the entire company.

EnPro battled with activist Warren Lichtenstein and his Steel Partners fund in 2008 after rejecting his acquisition offer of $47 per share, a 50% premium. EnPro faced substantial asbestos liabilities and the activist wanted a more aggressive strategy. They also sought the sale of a non-core business, a leveraged share repurchase and a possible sale of the company. A proxy battle ensued and shareholders voted to amend a poison pill, eliminate the staggered board, and elect a new board member nominated by Steel Partners. The company fortunately repurchased only half the shares demanded as the share price dropped in half during the 2009 market trough.

It’s clear that activists go far beyond screening for excess cash and low leverage, and now employ sophisticated investigative analyses in identifying targets and proposed strategies. Grasping the changing activist focus is the first step in keeping them at bay.

The Role of Governance

Propping up the public hullabaloo of activist shareholders are often a list of corporate governance demands supported by institutional investor advisors such as RiskMetrics and advocates such as the International Corporate Governance Network. These demands can include:

- Separate chairman and chief executive roles

- More independent directors

- Eliminating poison pills and related shields

- Dropping dual classes of stock that concentrate voting rights

- Declassifying a board to eliminate staggered elections

- Enhancing disclosures of desired information

- Revamping the methods and magnitudes of executive pay.

These stipulations aim to eliminate obstacles faced by the activist and potential takeover suitors, and are put forth in an air of righteousness with bold accusations of mismanagement. Indeed, in these times of public scandal, governance outcries become sound bites that win support among the media, the general public and other investors.

Although sensationalism can help them win over hearts and minds, activists rarely strike on a platform of improved governance alone. Governance attacks are usually more about publicity than substance.

However, governance can be germane to the strategic case. For example, if the activist asserts that management is overinvesting in growth without generating adequate returns and their case is supported by an executive compensation plan that rewards growth and operating profits more than returns, then the governance issue can become a strategic issue.

Managements shouldn’t ignore governance matters, as they do attract the media as honey attracts flies, but closing strategic and valuation gaps should be the top priority.

How to: Be Your Own Activist

Did you ever watch a football team go into defensive mode when ahead late in the game? Inevitably, by not trying to score, they end up getting scored upon and losing the game. As in sports, when dealing with activists, the best defense is a good offense.

Consider this activist checklist:

- What are investor expectations for growth and return, and how does this compare to internal plans? Are there gaps, indicating potential upside you are not pursuing?

- Is a business unit performing poorly, consuming resources and distracting management? Can it improve? Is it core? Should it be sold?

- Is cost excessive or is too much capital invested in low-return, undifferentiated businesses?

- How does growth compare to peers? Is growth investment adequate including capital, marketing, advertising and research and development?

- Are resources allocated based on economic merits or internal politics? Are investors concerned about reinvestment risk?

- Is performance sustainable or are there patents and brands that are losing value? Are they worth investing in or should the cash flows be harvested?

- Are there corporate governance concerns?

- Is the behavior motivated by compensation well aligned with owners to “incentivize” a balance of long and short term, and risk and reward?

Consider each potential issue that could attract an activist and categorize each as:

A. No problem

B. A problem, but the solution would be worse

C. A problem, and we should act now

Long before an activist arrives, know the A and B items and prepare responses in advance. For example, suppose an activist demands the sale of a business unit but the tax consequences would transfer the value creation to the government. A quick comprehensive public explanation of the flaw in the suggestions will encourage the activist to move on. The response must be quick, accurate and head on, not a deflection.

For C items, carefully and thoughtfully develop and execute a strategy that creates value. That is, Be Your Own Activist. These actions can at times be unpleasant, which is often why they have not been done already, but it will be decidedly more unpleasant if an activist forces these actions upon you.

Does Activist Investing Work?

There are no conclusive studies on the effects of activism and perhaps there never will be as there are a wide variety of unique activist styles which render conclusions anecdotal at best. To ponder the effects, we need to define success. Some measure success as total shareholder returns versus peer companies during the holding period. This is an apparently scientific process and studies of this type tend to show that activists generate returns in excess of benchmarks on a risk adjusted basis.

But many in the corporate world wonder if these positive results hold up over longer periods of time. Are the companies essentially milked in the short term and left weaker in the long term, after the activist is gone?

There are numerous cases of companies that bought back shares during the bull market as demanded by activists and now they sit at half the share price. In some cases the stock jumped on the buyback but looking back now, was this truly in the interest of shareholders? How many companies entered the financial crisis with too much debt, making them weaker just when they needed balance sheet strength?

These are valid concerns, but for every case where the activist seems to have stimulated a short term pop in the share price but a resulting long term wane, there are numerous cases the activists point to where management seemed blind to an important strategic move and the activist stimulated it. In fact, in many cases they really have stimulated true long term value creation.

This debate will rage on as long as there are activists, but managements shouldn’t waste time deliberating this. Whether we like it or not, activists are here to stay and a better use of management time is to Be Your Own Activist, drive your share price higher and keep the real outside activists looking elsewhere.

Gregory V. Milano is Co-Founder and Chief Executive Officer of Fortuna Advisors LLC

gregory.milano@fortuna-advisors.com |