The core services of Fortuna Advisors fall within the corporate strategy area and are organized as Advice or Process. The core services of Fortuna Advisors fall within the corporate strategy area and are organized as Advice or Process.

1. Corporate Strategy Advice

- Strategic Planning Advice

- Business Portfolio Analysis & Business Unit Strategy

- Developing Growth Plans

2. Corporate Strategy Process

- Strategic Planning Process

- Resource Allocation

- Performance Measurement

1. Corporate Strategy Advice

Strategic Planning Advice: We apply our analytical framework as a catalyst to prepare and provide advice on strategic direction and initiatives, which can become an ongoing process of checks and balances desired by many clients. We prepare and evaluate analyses of client performance, market expectations and peer benchmarks on a handful of critical value drivers. We then test the viability of various paths to growth and residual income margin improvement to determine the best path forward. In our experience, this often prompts the client to consider alternatives previously considered undesirable or unachievable.

Business Portfolio Analysis & Business Unit Strategy: Technological innovation, a significant M&A wave over the past several years, and a renewed focus on internal innovation have left many corporations with complex and at least partially underperforming business portfolios. Fortuna Advisors assists clients in designing and implementing appropriate strategies for each business unit. Gone are the days when one strategy is smeared across the portfolio. Since competition happens at the business unit level we encourage each business unit to develop and execute its own plan, focusing on growth, efficiency, consolidation or exit depending on the situation. Fortuna Advisors takes into account the specific market dynamics, product opportunities and customer insights as appropriate to assist our clients in optimizing their business portfolio.

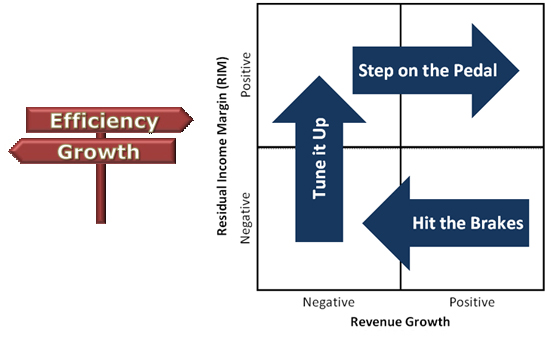

Developing growth Plans: Growth is critical to long term value creation as there is a limit to how far margin expansion alone can take a company over time. But the blind pursuit of growth runs the risk of destroying value as the wrong businesses receive investment dollars and are grown. By evaluating where a business sits on the growth versus RIM graph, it becomes clear what the strategy should be. Businesses with negative RIM should generally stop growing until the RIM can be turned positive. That is unless the growth itself will be the key to driving RIM higher, perhaps due to utilization of excess capacity. In essence, businesses should earn the right to grow. Once a business has generated and can sustain strong positive RIM, the greatest source of value creation is growth.

We apply the following simple framework:

Back to Top

2. Corporate Strategy Process

Strategic Planning Process: Many companies are dissatisfied with their current planning process, often steeped in bureaucracy and data compilation rather than strategic dialogue, and rarely leading to true creative development. Fortuna Advisors assists clients in designing and implementing world-class planning capabilities based on the key drivers of value, linking both internal information and knowledge with external signals from the market and the ever changing competitive landscape. We help management transform data into key metrics by focusing them on what’s necessary to make key decisions. And we will help them see how to apply these metrics and processes to enhance strategic discussions and eliminate unnecessary efforts.

Resource Allocation: Shocking as it may seem, “Based on Last Year’s Budget”, “First Pig to the Trough” and “Use It or Lose It” are commonly quoted sayings about the ineffective allocation and utilization of capital and other scarce resources across a business portfolio. This is where many multi-business line companies lose their way and destroy value. Fortuna Advisors enables clients to implement capital budgeting methodologies that are based on our analytical framework and align with the overall strategic planning process.

Performance Measurement: To assist clients in implementing their strategies and allocate resources in a manner that creates value, the proper performance measurement scorecards need to be in place. This facilitates ongoing course corrections and enduring accountability. Our recommendations for key management metrics are based on our valuation framework and our assessment of key value drivers with consideration for industry fundamentals. Scorecards combine both internal and external data and insights to allow real time market insights and benchmarking.

Back to Top |