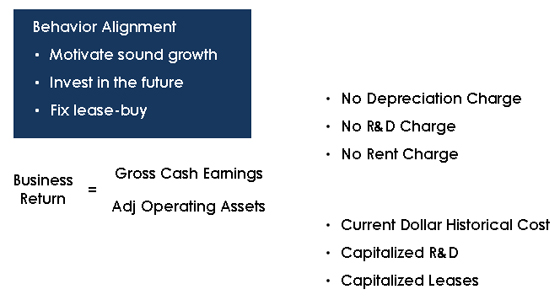

Adopting the “right” measure of Business Return is critical in incorporating a value-based methodology into the corporate strategic planning process. On one extreme, a purely accounting based return is easy to implement but it does a poor job of providing the right signals on the potential return of the next dollar of investment. On the other extreme, overly complex models are difficult to understand, implement and manage, resulting in frustration for corporate managers.

At Fortuna Advisors, we avoid many of the weaknesses in other value-based models by following these basic principles:

- The measure should be straightforward and easily understood.

- Complexity should only be added for material gains in our ability to understand the relationship between corporate performance and market valuation over time.

- The measure should fairly represent the company’s performance and encourage growth.

The measure should link back to the market adequately so as to have confidence that decisions made to improve the measures are likely to increase the share price over time as results materialize.

|