| |

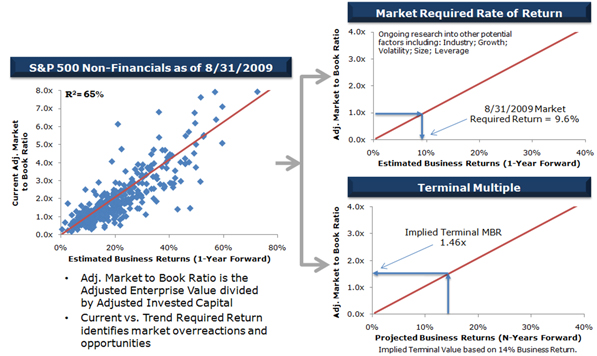

The multiple of a companies valuation relative to the total investment into the business is closely tied to the business return the company earns. Those that earn high returns trade at high multiples of assets and vice versa. We use this to establish the required return.

In addition to establishing the RR, this regression has many purposes in the Fortuna Advisors analytical framework. For example, as a means of determining the terminal value of a business at the end of a forecast, this regression provides a market sensitive indication based on how large the asset base grows during the forecast and the level of return achieved.

In strategic analysis and periodic market studies, the relationship between valuation and return provides insights into relative peer trading multiples and current market expectations. Peers valued well below (above) the line indicate performance expectations that are declining (increasing) on a relative basis, that growth expectations are different, that it has a differentiated corporate strategy or that a company is over or under valued versus the peers. Detailed analysis indicates the causes of these apparently high or low share prices and can often be traced to future value drivers such as growth investments in R&D, Brands and the like.

Fundamental industry dynamics, in the eye of the investor, become readily apparent. Industries with steeper slopes than the market are seen as more sustainable and those that are flatter seem to be more commodity in nature. This approach has proven to be quite an intuitive strategic framework for clients, making the findings and recommendations of Fortuna Advisors quite accessible.

|

|