| |

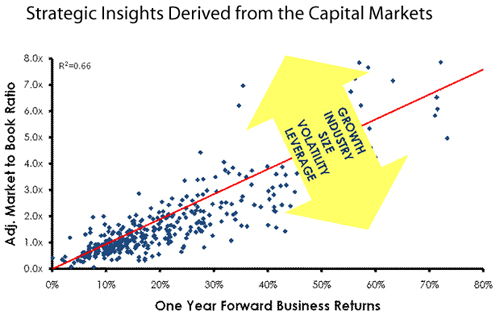

The required return is derived from the relationship for a large sample of companies between Business Returns and the Market-to-Book Ratio (MBR), based on enterprise value to our adjusted measure of operating assets. The BR that relates to an MBR of 1.0x, reflects no positive or negative Net Present Value (NPV) and therefore is the Market’s Required Return (RR).

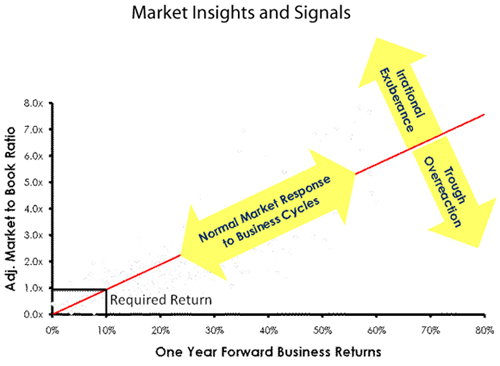

We determine a Spot Required Return (SRR) quarterly but use a Trend Required Return (TRR) with smoothing to encourage a “Buy Low Sell High” mindset by explicitly recognizing when the market is generally high or low and using this as an element of strategic plan development. Investments generally look more attractive when the market is low and more expensive when the market is high, as opposed to many frameworks which either ignore market indications by using a traditional Weighted Average Cost of Capital (WACC) or use a market derived framework that constantly resets to the market.

|

|