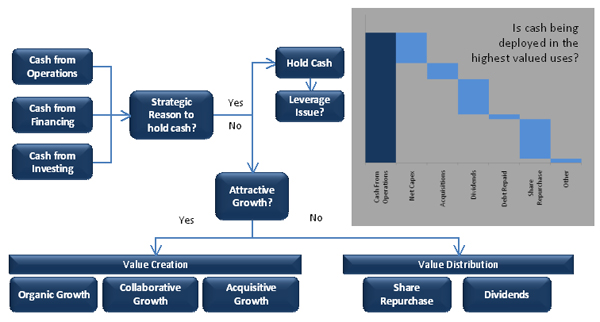

Companies generate cash from three primary sources: Operations, Investing Activities and Financing. When making decisions on where to deploy this cash however, many companies use different metrics resulting in an inability to properly assess whether cash is being deployed to its highest value-creating use.

For example, growth capital is often rigorously analyzed through detailed NPV/IRR analysis. However, maintenance capital is often ‘automatically’ approved. Decisions about capital structure and share repurchases are often made based on the impact to EPS. Finally, despite all of this analysis, managers are then compensated on operating profit growth or other metrics that were little used during the decision/planning phase.

Fortuna Advisors’ framework compares all of these decisions through a holistic and consistent lens that allows true comparability for manager to ensure capital is being deployed in the best interest of shareholders.

|