| |

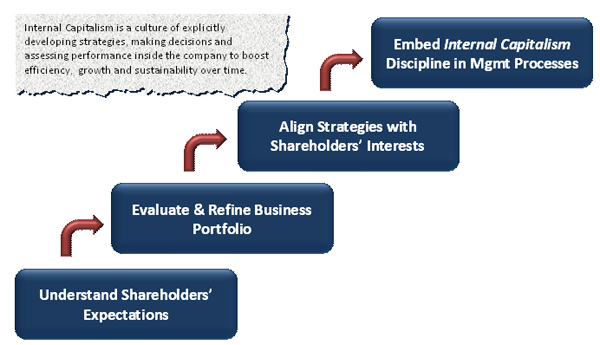

The spirit of Internal Capitalism, as the directive to maximize shareholder value, should steer strategies, decisions and performance measures. Modern corporate finance dictates that value is the present value of the cash flow a business is expected to generate over time. The business units maximize cash flow by operating efficiently while making growth investments that promise an adequate return.

For a shareholder value decision framework to be effective, management must embrace the notion that value creation is the prime objective and practice Internal Capitalism. This will lead to an owner-like frame of mind, treating the company’s resources as if they were their own.

|

|