- Expectations exist for revenue growth, margins, capital, EBITDA, EPS, etc. - Expectations exist for revenue growth, margins, capital, EBITDA, EPS, etc.

- Start with consensus but what is embedded in the share price?

- Understanding investor expectations is important for:

- Evaluating value creation embedded in business plans

- Assessing performance

- Considering breakeven requirements of acquisitions

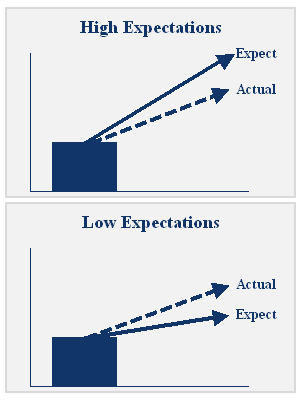

- Two companies with the same actual results may have very different share price reactions due to investor expectations

|