Many companies allocate capital in ways that don’t improve the performance of the business:

Allocations are often made along the following rationales:

- Last year’s budget plus or minus

- Depreciation expense + an estimate for growth

- Contribution to sales or operating profit in absolute dollars

- Internal politics

The problem is that allocating capital in this manner fails to direct valuable corporate resources (money AND management time) and often results in sub-optimal performance.

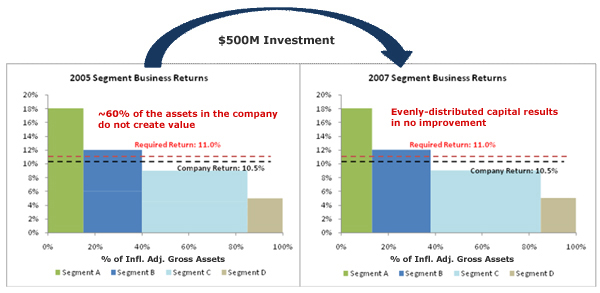

Traditionally, capital was allocated based proportionately to size and legacy management issues, resulting in continued sub-par performance

|

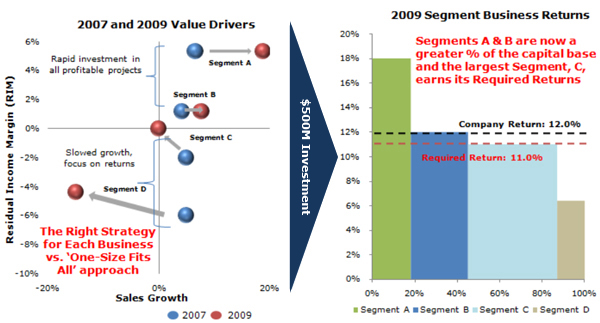

However, by allocating capital across the business based on the prospects for returns and growth as emphasized in our ‘Growth/Return Trade-off Matrix’, business segments can begin to drive value creation for the entire business.

The return based approach creates an “Internal Capitalism” system where resources are allocated based on the ability to generate a return on the next dollar of capital.

|

|